A financial expert has highlighted key pension inquiries individuals should consider, coinciding with a study showing a rise in the use of social media for personal finance information.

Research conducted by AYTM for TikTok indicates that one in three UK users now rely on the platform for financial insights, with 41% encountering banking-related content on their feeds.

Scottish Widows is leveraging TikTok to engage Gen Z in pension planning, with over 191,000 posts under #retirementplanning and 323 million video views since joining TikTok in September 2024. HSBC and Nationwide have also reported millions of views on their personal finance content on TikTok.

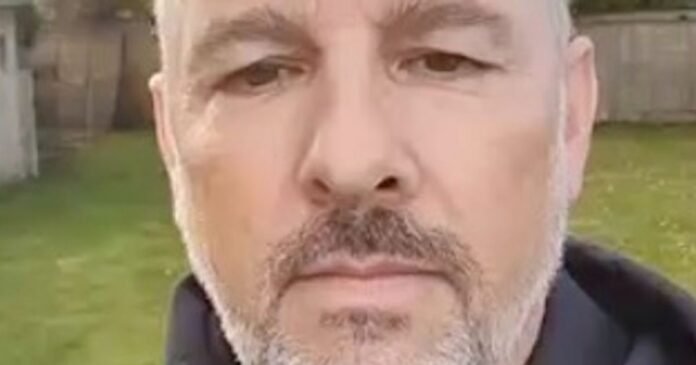

Pension expert Robert Cochran from Scottish Widows shared advice with the Mirror for individuals struggling to initiate their pension journey or optimize their retirement fund.

To ensure you keep track of your pension savings, especially if you have multiple pension pots due to job changes, it is crucial to reach out to your pension providers for a clear overview of your accumulated savings. The UK government offers a free pension tracing service via GOV.UK to help locate any lost pension funds.

Robert Cochran recommends using pension provider apps to monitor private or workplace pension schemes and checking your state pension forecast through the HMRC app to understand your future pension income.

Determining the type of retirement lifestyle you are on track to achieve is essential. The Pensions and Lifetime Savings Association outlines three retirement standards – minimum, moderate, and comfortable, with corresponding annual costs for two people.

If you find that you are not on track for your desired retirement lifestyle, consider increasing contributions to your workplace pension. Through auto-enrolment, employers contribute a minimum of 3% to your pension while you contribute 5%.

Consolidating your pension pots into one plan is another option to streamline and manage your pensions effectively. Evaluate existing fees, compare costs with other options, and assess any exit fees before making a decision on consolidation.

By taking these steps, individuals can better understand and optimize their pension savings for a secure retirement.